Aligning Your Values,

Vision and Wealth

Markets Are Unpredictable

We Are Not

LEARN MORE

ARE YOU THE FEW?

ARE YOU THE FEW?

The Vision to

Wealth Process®

Aligning Values, Vision and Wealth

We design, implement, and maintain custom-tailored wealth management strategies and solutions for affluent families.

Read More

Upcoming Events

We are educators and focused on telling you the truth about the markets and about investing.

Read More

How to Be Your Best

When you are random with your thoughts and actions, mediocrity can result in lost opportunities. We can help you to be your best.

Read MoreWe are a fiduciary!

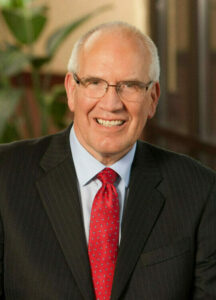

About Wayne

My purpose is to help you find contentment and happiness in living a simpler, but more successful financial life.

Our Vision

To be the clearly superior choice for people seeking integrated wealth management from a dedicated team who will exceed their expectations consistently.

The Truth Project Book

Wayne von Borstel, CFP®, ChFC®, CLU, MSFS, takes us on an eye-opening journey through the minefield of financial myths that prevent too many from reaching a fulfilling retirement. Based on a quarter century of experience as a financial coach and advisor to high net worth investors, the author goes beyond merely warning about the perils of financial myths. He provides alternative strategies based on a foundation of core truths that cut through the ubiquitous financial propaganda generated by product marketers and their media cohorts.

Upcoming Events

Monthly Coaching Call: Melinda Caughill

Monthly Coaching Call: Making It Last

Randomness vs. Financial Readiness

Free Second Opinion

Financial decisions are hard to make. Our VISION TO WEALTH PROCESS™ can help. Please provide your name and contact information and we will be in contact with you shortly to schedule your free second opinion.