When Can “Lumpy” Be Good?

The word “lumpy” doesn’t evoke a lot of positive thoughts. Lumpy greens aren’t fun to putt on, and a lumpy mattress isn’t going to lead to a good night’s sleep. But there are times when lumpy can be good, especially if we are talking about charitable giving and itemized deductions.

The Tax Cuts and Jobs Act (TCJA) is the largest change to the tax code in more than 30 years. With that change, we need to rethink our assumptions and our habits. In the past, you may have made annual cash donations to your favorite church or charitable organization. When it came time to file your tax return, you likely were able to itemize various deductions and exceed the standard deduction amount. Under the new rules of the game, the TCJA has more or less doubled the standard deduction. As such, it is expected that 94% of households will take the standard deduction in the future (as compared to 70% of households previously).

In my last post, I highlighted the benefits of a Qualified Charitable Distribution (QCD). While it could be an excellent strategy for those over the age of 70 ½, it doesn’t apply to everyone. So for the rest of us, how can we be more intentional with our giving and receive some tax benefits along the way.

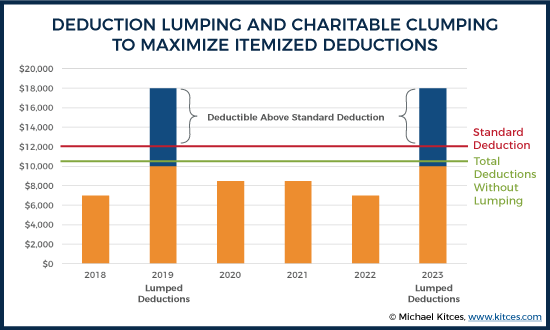

One strategy would be to “lump” our charitable giving in one calendar year so that our itemized deductions exceed the standard deduction, and then simply claim the standard deduction in following year(s). The following graphic attempts to illustrate what this might look like for an individual taxpayer.

Our lumped contributions could still be made directly to charities in cash, but some people would rather make those distributions over multiple years, so the charity has on-going support.

Is there a way to make a lump sum contribution but disperse funds to the ultimate charity over multiple years? Absolutely! A Donor Advised Fund is one potential solution.

What’s a Donor Advised Fund? Glad you asked.

A Donor Advised Fund (DAF) is a special type of account that is maintained and operated by a qualifying 501(c)(3) charitable organization. Once the contribution is made to the DAF, those funds qualify for a charitable deduction on the donor’s tax return. In future years, the donor may direct distributions to be made from the DAF to the ultimate charity of their choice. At that time, no additional charitable deductions are claimed by the donor.

So combining a DAF with “lumpy” charitable giving would allow consistent annual distributions to your favorite charities, while potentially providing additional tax benefits for you.

If this concept is intriguing to you, give us a call so we can review your situation, discuss your options, and help you make a better overall decision! “Aligning Values, Vision and Wealth”™ is our trademark for a reason.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.